From Lab to Market - The Rise and Impact of Precision Fermentation

🗓️ November 27, 2025

Process Technology, Market Growth and Key Cost Drivers

Precision fermentation is transforming the way we produce essential food ingredients. This article explains the current market landscape, what drives the cost of production, and how process technologies determine scalability, product quality, and commercial success.

1. What Is Precision Fermentation?

Traditional fermentation has been used for centuries to produce foods such as yogurt, bread, beer, and wine. Precision fermentation represents a more recent evolution: instead of relying on naturally occurring microorganisms, engineered microorganisms: modified through gene insertion, genome editing, or directed evolution are used to produce non-native, high-value food ingredients, including proteins found in dairy, eggs, meat, or other functional compounds.

This is distinct from mammalian cell culture, which cultivates animal cells directly to produce meat or fats. While cell culture offers remarkable complexity and functionality, it remains expensive and technically demanding.

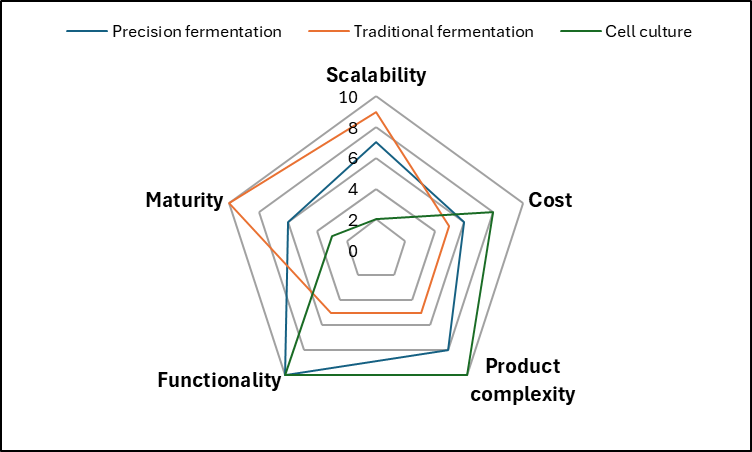

All three approaches, traditional fermentation, precision fermentation, and cell culture share a common objective: to create alternative, sustainable food supply chains using diverse carbon sources such as glucose, methane, CO₂/H₂, methanol, or formate. However, they differ substantially in maturity, scalability, cost profiles, and product complexity.

Figure 1 illustrates how these technologies differ in scalability, maturity, cost, and product functionality. Traditional fermentation is highly mature and scalable but limited in the types of ingredients it can produce. Cell culture achieves exceptional complexity but remains costly. Precision fermentation sits between the two: more scalable and cost-effective than cell culture, but able to produce more complex ingredients than traditional fermentation.

Figure 1. Difference in scalability, maturity, cost, product complexity & functionality between the traditional fermentation, precision fermentation and cell culture

Because engineered microorganisms have unique growth and production requirements, each precision fermentation process demands tailored process development and optimisation. This has important implications for scalability and cost.

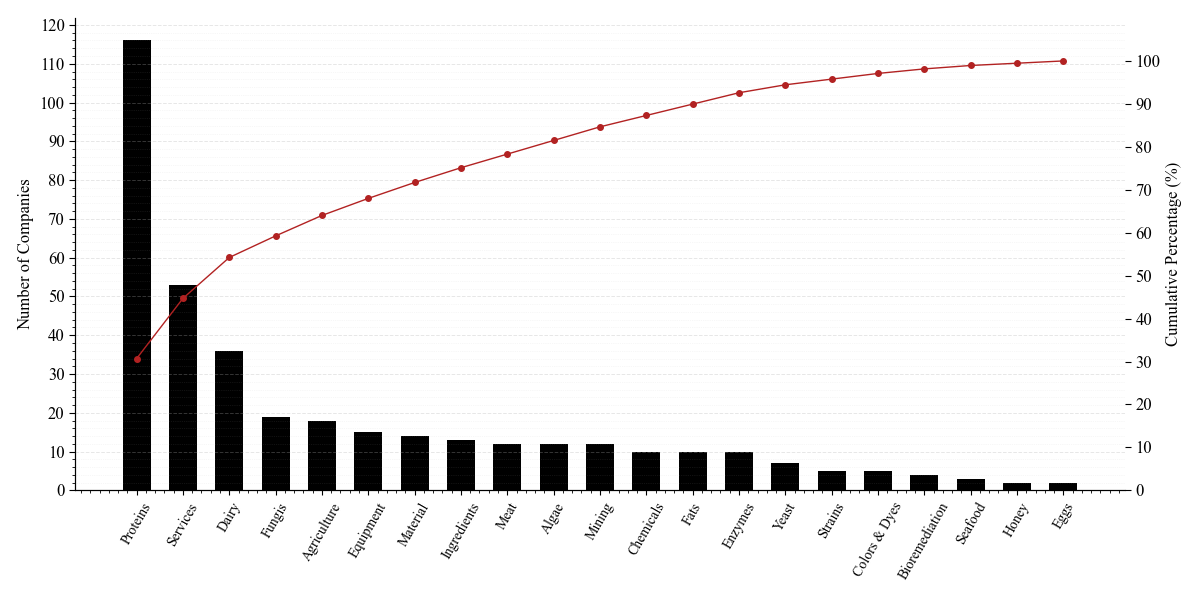

Figure 2 shows a Pareto chart illustrating the novel fermentation activities identified by GFI[1] and the microbiome mavericks[2]. Companies have entered many different sectors to meet market demand, with alternative proteins standing out as the most prominent area.

Figure 2: Pareto representation of the different type of novel application of Fermentation[1][2], protein category includes recombinant protein (e.g., collagen production from yeast)

Given the size and growth of the alternative food sector, this article focuses specifically on precision fermentation for food applications.

2. Market Snapshot & Growth Trajectory

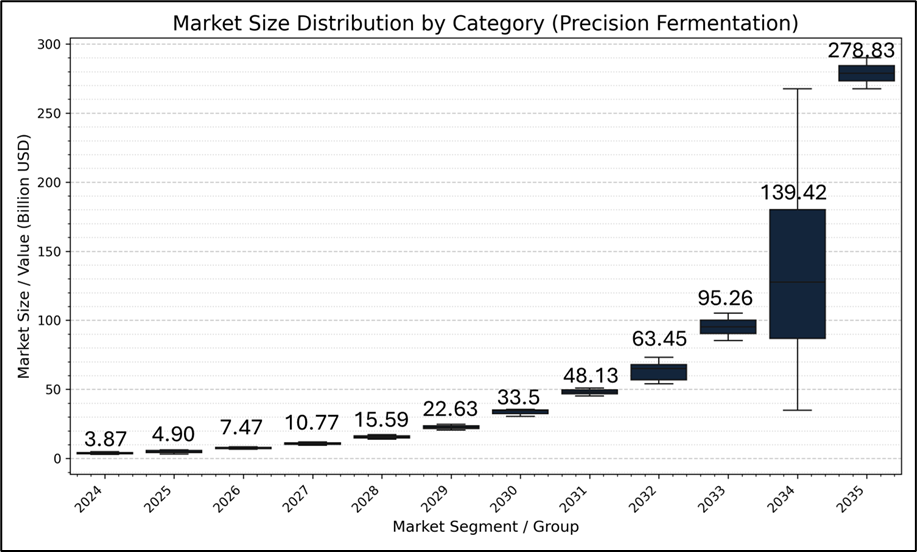

The precision fermentation market for food ingredients is expanding rapidly. According to multiple market analyses, the sector is valued at approximately $4.9 billion today and is projected to reach $278.8 billion by 2035, despite variability in forecast methodologies (Figure 3).

This growth is driven by; rising demand for sustainable food production, increasing global population, pressure to reduce environmental impact and consumer interest in animal-free alternatives.

Figure 3: predicted market size for precision fermentation[3]

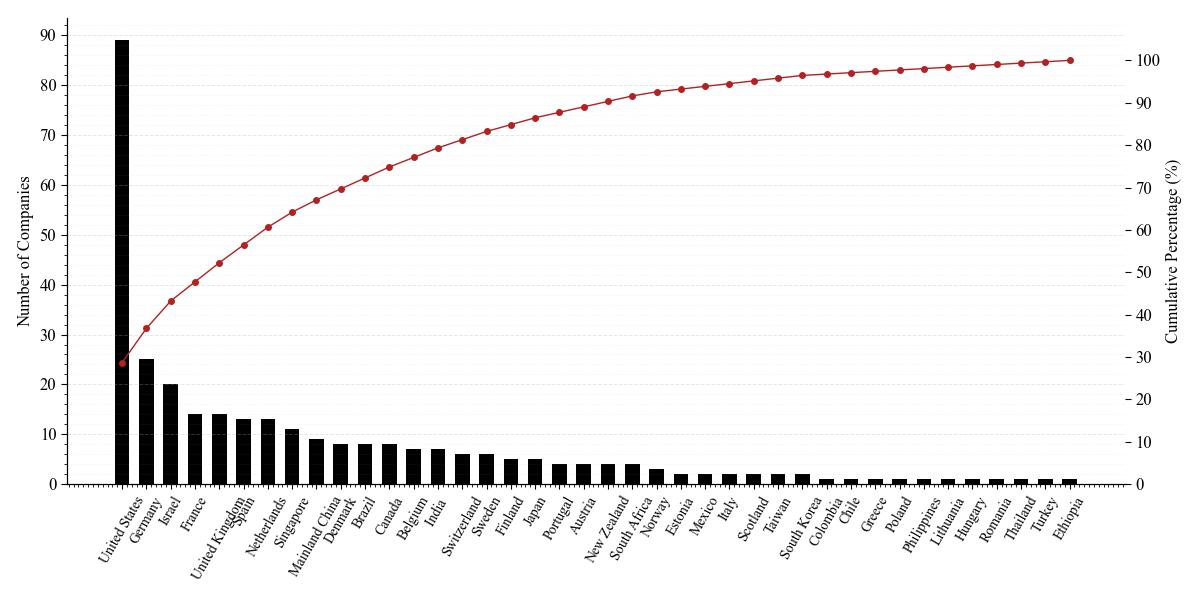

Precision fermentation companies operate globally, with the United States currently hosting the largest concentration, followed by Germany, Israel, France, the UK, Spain, and the Netherlands (Figure 4). Most countries have fewer than 10 companies today, and this landscape is expected to shift as demand increases.

Figure 4: Pareto representation of the location of the different novel precision fermentation companies around the world [1]

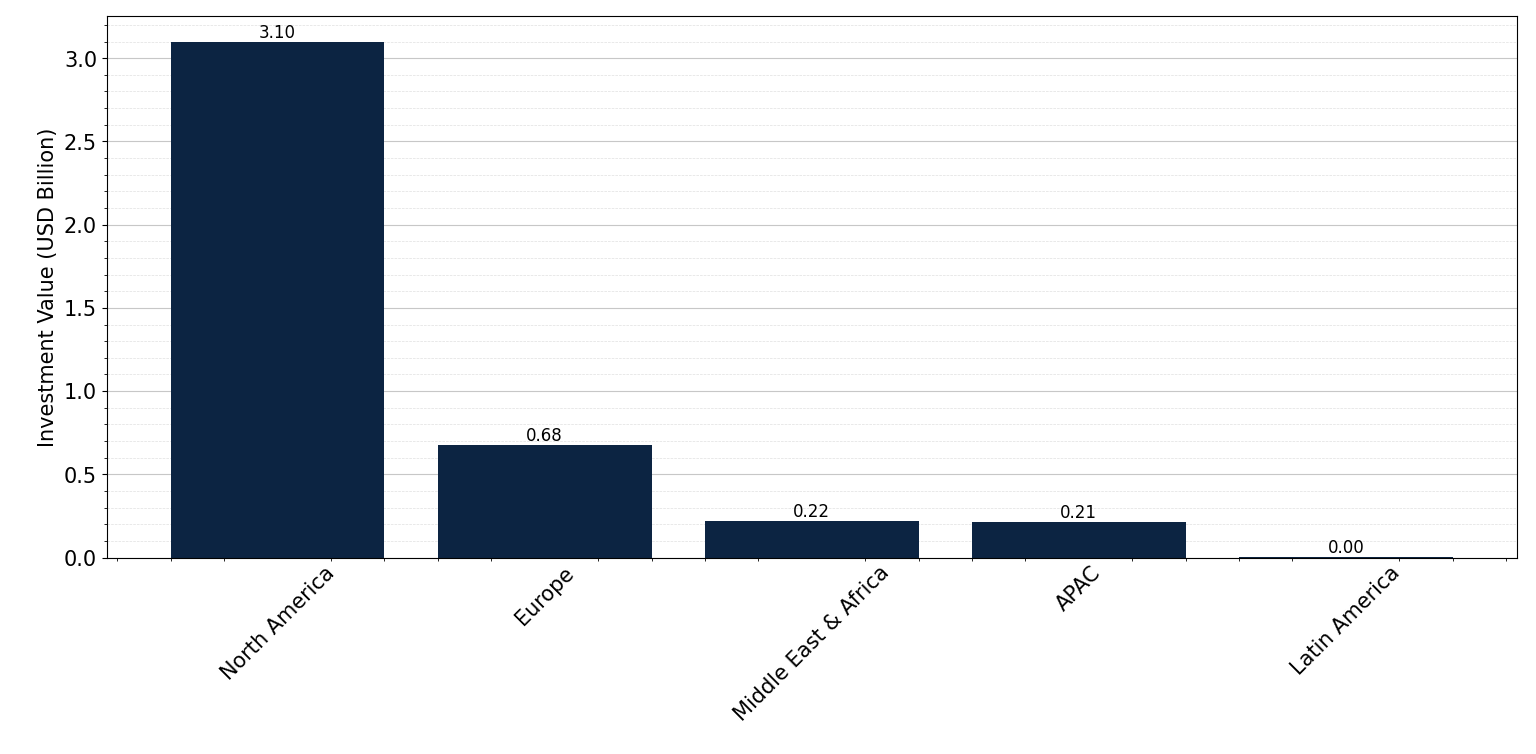

Investment trends mirror company distribution. The United States invests 4.5 times more in fermentation-based food technologies than Europe (Figure 5), shaping global innovation dynamics.

Figure 5: Investments in fermentation by Region in 2023[4]

3. What Drives Competitiveness in Precision Fermentation?

Bringing a new precision fermentation product to market requires navigating a set of fundamental principles (Figure 6). These determine not only whether the product can enter the market, but whether it can succeed commercially.

Figure 6: Fundamentals in product acceptance by consumers

3.1. Safety and Regulatory Compliance

Products must meet stringent regulatory requirements, which vary by geography. Safety includes:

absence of microbiological and chemical contaminants

validated upstream processing (USP) and downstream processing (DSP)

robust quality assurance and traceability

3.2. Product Availability and Supply Volume

Consistent supply is essential for repeat purchase and integration into daily consumer habits. Production capacity must be designed to meet projected demand, without significant under- or over-production.

3.3. Price Competitiveness

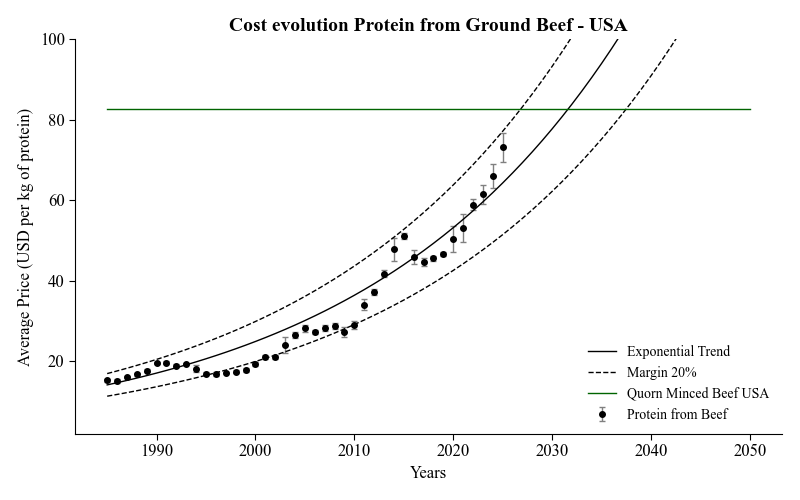

Even highly functional alternative ingredients struggle to achieve market penetration if priced significantly above conventional equivalents. For example, fungi-based meat alternatives must compete with rising beef prices, which have increased from $19.20/kg of protein (2020) to $73.10/kg (2025), driven by inflation and production costs (Figure 7). According to this analysis, the two products will reach price parity between 2027 and 2037.

Figure 7: Evolution of the Price of protein from Ground beef over the years in the USA[5], comparison with current cost of protein from Quorn minced beef (the calculation was conducted considering an average of 18% protein in Ground beef and 16% in Quorn Minced Beef). The green line corresponds to current price (2025) of Quorn Minced Beef in the USA (per kg of protein).

3.4. Product Functionality

Precision fermentation ingredients must meet consumer expectations for flavour, texture, aroma, and appearance. These attributes are directly influenced by fermentation conditions and DSP.

4. How Process Technology Impacts Market Success

Process technology is central to scaling precision fermentation. It determines cost, safety, reliability, volume, and product quality. These engineering and operational decisions have greater impact on competitiveness than any single biological innovation.

4.1 Feedstock Economics: The Largest Variable Cost

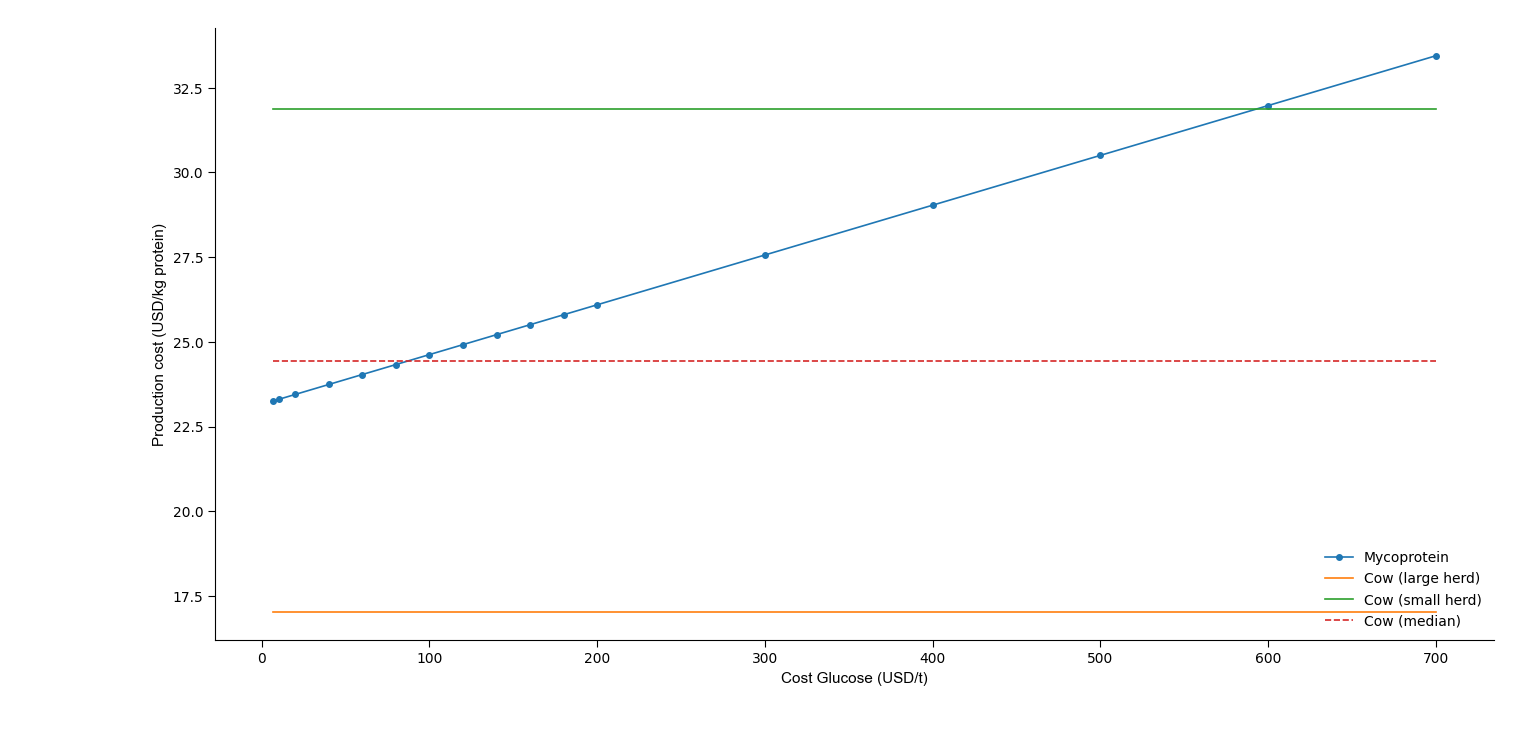

Feedstock—usually glucose—represents the largest variable cost in most fermentation processes. Glucose prices vary significantly globally, making site selection a major economic lever (Figure 8).

Figure 8: Production cost mycoprotein vs Raw Angus beef

For this calculation:

Cost per head (small and large herds)[8]

Yield meat extraction %[9]

Weight Angus average[10]

%protein raw meat[11]

Cost of processing meat[12]

Using the techno-economic model by Risner et al., the cost to produce mycoprotein can be compared to the cost of beef protein in the United States: At $360/tonne glucose, mycoprotein costs $29/kg protein, competitive with beef from small herds. Mycoprotein costs could fall to $24/kg, reaching parity with median beef protein cost but that would require reducing the cost of glucose to $89/tonne (e.g. using waste derived glucose).

Geography and feedstock sourcing strategies therefore significantly shape competitiveness.

4.2. Process Stability, Uptime, and Operational Reliability

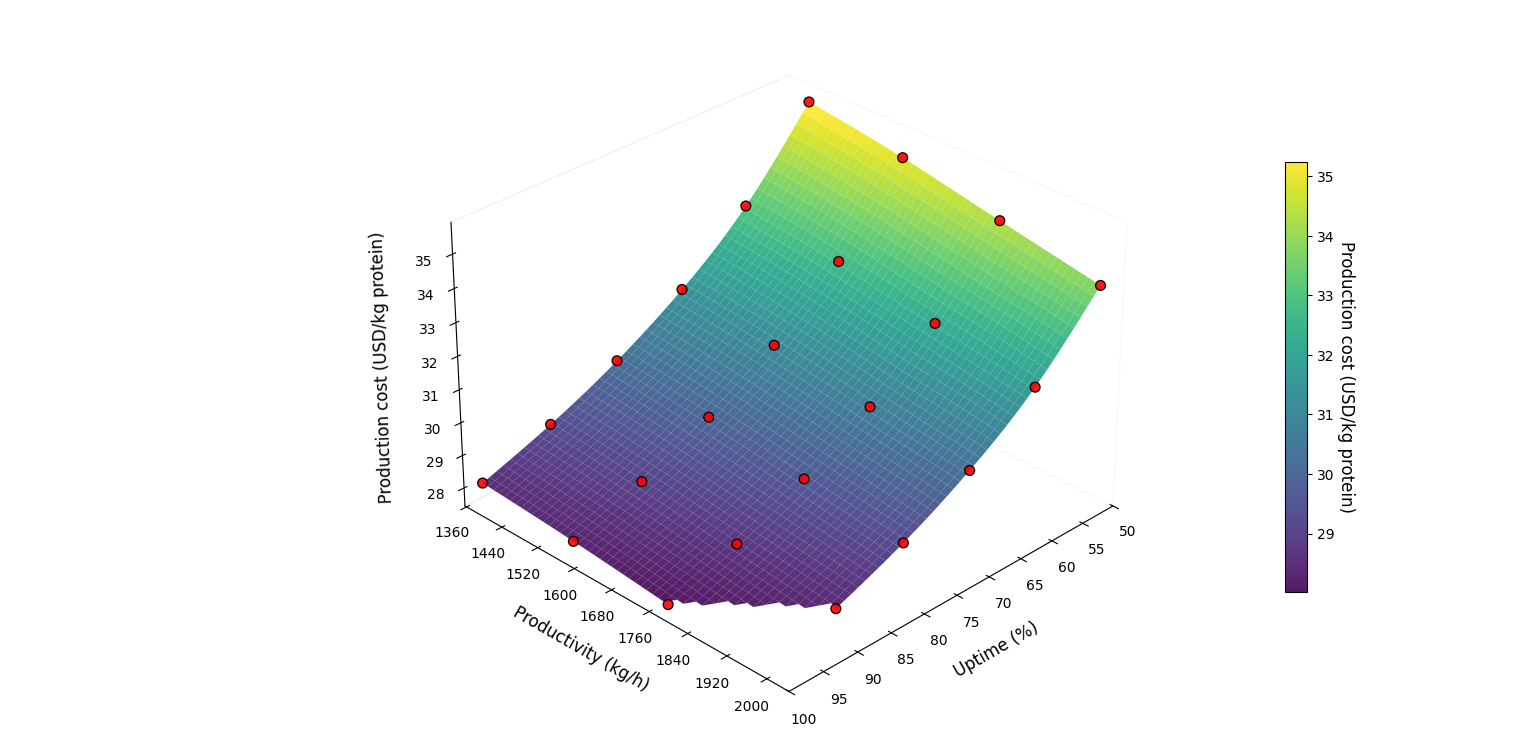

Uptime is one of the strongest determinants of cost. Process interruptions caused by contamination, equipment downtime, or unstable operating parameters increase COGs and reduce output.

Figure 9 shows how production cost varies with uptime and productivity. Achieving ~70-80% uptime is realistic with redundancy in critical equipment, robust CIP/SIP validation, trained operators and strong maintenance regimes.

As described in a previous blog post, increasing uptime is often more impactful than increasing reactor volume.

4.3 Quality Assurance and Contamination Control

Ensuring product safety requires validated CIP/SIP cycles, effective contamination mitigation in fermenter design, feedstock quality controls, statistical process control of final product parameters, validated thermal treatments (e.g., pasteurisation).

A strong QA system ensures consistent product quality and regulatory compliance.

4.4 Downstream Processing and Sensory Quality

Fermentation conditions influence the organoleptic properties of food-grade products. For instance; poor control of pH and temperature can generate unwanted metabolites, heat treatments (UHT, pasteurisation) can alter texture and flavour, cell wall solubilisation affects water binding and Maillard reactions impact colour and aroma

DSP technologies, such as drying methods, further affect particle size, density, rehydration behaviour, aroma, and shelf life.

Meeting consumer expectations requires tight control over both USP and DSP.

Figure 9: Impact of Uptime and system productivity on Production cost based on ref [7]

Conclusion & Next Steps

Precision fermentation is poised to expand significantly over the next decade. As demand for sustainable, functional food ingredients grows, the technology’s ability to produce complex proteins from diverse carbon sources positions it as a critical part of the future food system.

However, commercial success depends on more than biological innovation. Process technology, spanning feedstock sourcing, reactor design, uptime, QA, and downstream processing, ultimately determines price, quality, and scalability.

In the next article, we will explore:

the specific process technologies shaping the sector

which companies are setting benchmarks

how to reduce scale-up risk and accelerate commercial deployment

These insights are essential for companies looking to bring precision fermentation products to market efficiently and competitively.

Sources:

[1] Good Food Institute (GFI): https://gfi.org/resource/alternative-protein-company-database/

[2] Hacksummit: https://hacksummit.beehiiv.com/p/100-mavericks-using-microbes-to-transform-climate-tech

[3] precedenceresearch, fortunebusinessinsights, businesswire, grandviewresearch, towardsfnb, rootsanalysis, custommarketinsights, coherentmarketinsights, marketresearchfuture

[4] Good Food Institute (GFI): 2024 State of the Industry report

[5] FRED (Federal Reserve Bank of St Louis): https://fred.stlouisfed.org/

[6] WITS (World Integrated Trade Solution): https://wits.worldbank.org/trade/comtrade/en/country/USA/year/2023/tradeflow/Imports/partner/ALL/product/170240?utm

[7] Risner Derrick , McDonald Karen A. , Jones Carl , Spang Edward S., A techno-economic model of mycoprotein production: achieving price parity with beef protein, Frontiers in Sustainable Food Systems, Volume 7 – 2023, 2023. DOI=10.3389/fsufs.2023.1204307

[8] USDA (US Department of Agriculture): Larger Beef Cow-Calf Farms Have Lower Costs per Cow Than Smaller Operations | Economic Research Service

[9] University of California (Agriculture and Natural Resources): Microsoft Word - Carcass Yields_Sample Graphic.docx

[10] USDA (US Department of Agriculture): Livestock Slaughter 2024 Summary 04/23/2025

[11] Nutrionio: Raw beef calories and nutrition facts

[12] Ge H, Gómez MI, Peters CJ. Overcoming slaughter and processing capacity barriers to expanding grass-finished beef cattle production in the northeastern USA. Renewable Agriculture and Food Systems. 2025;40:e2. doi:10.1017/S1742170524000310

Want more?

We help companies model this exact problem, from up-time simulations to CAPEX vs COGs design trade-offs.

✉️ Contact us at A&A Biotech Consultancy Ltd.

Turning fermentation insight into industrial success.